Get to Know the Pefindo i-Grade Index and Pefindo Prime Bank IDX: Fundamental-Based Investment Guide

In an effort to strengthen capital market literacy and provide fundamental-based investment guidance, Pefindo has launched two superior indices: Pefindo i-Grade And IDX Pefindo Prime Bank. These two indices are designed as a reference for investors, including retail investors, to invest capital in companies with good fundamental quality based on Pefindo's credit rating.

Strong Foundation of Credit Ratings

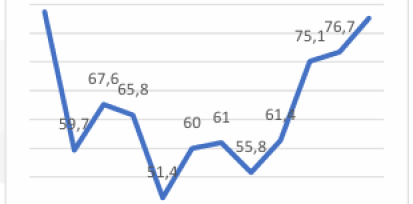

Index Pefindo i-Grade consists of 30 companies with the best fundamental quality. Based on ranking data, as many as 77% of the index's constituents are rated AAA, 9% AA, and 6% AA-. This means that the majority of companies in this index have financial stability and strong governance.

Meanwhile, IDX Pefindo Prime Bank targeting 10 main banks which are market movers in the banking sector. The four major banks—BCA, BRI, Bank Mandiri, and BNI—became the core constituents, with the remainder being satellite banks such as BSI, BTN, Bank Permata, Panin, CIMB Niaga, and Danamon. Around 71.4% of total banking industry assets covered in this index, as well 83.47% of financial sector market capitalization on the Indonesian Stock Exchange.

Sector Composition in Pefindo i-Grade

The Pefindo i-Grade index is not limited to one sector, but is multi-faceted semi broad-based. The sectoral composition includes:

- Banking: 65%

- Telecommunication: 11,9%

- Holding companies, chemicals and mining, as well as other sectors.

The total market capitalization of i-Grade constituents covers approx 37% of JCI market capitalization.

Derivative Investment Products: Who Has Made Profits?

These Pefindo indices have been used by several investment manager to form ETF and index mutual fund products, including:

For Pefindo i-Grade:

- Indopremier Investment Management (ETF)

- Major Asset Management (ETF)

- Batavia Prosperindo Asset Management (Index Mutual Funds)

- BNI Asset Management (Index Mutual Funds)

Being processed:

- Bahana TCW Investment Management (ETF)

- Simas Asset Management

For IDX Pefindo Prime Bank:

Available:

- BNI Asset Management (Index Mutual Funds)

Will follow:

- Indopremier (ETF, release around the end of February)

- Batavia Prosperindo (in process)

The total managed funds of Pefindo i-Grade based products already on the market have approached IDR 1 trillion, indicating high investor interest and trust.

Opportunities for Retail Investors

Retail investors don't need to worry about being left behind. Pefindo's ETF and index-based mutual fund products provide fundamentally curated investment opportunities. Especially in the midst of a weakening JCI condition, entering index mutual funds at low valuations can be a profitable long-term strategy, of course taking into account the respective risks.

Pefindo's Hope and Mission

Through the launch of these two indices, Pefindo hopes to be able to provide credible guidance for investors in choosing quality shares. This index is also expected to contribute to market deepening, increasing exchange transactions, and ultimately creating healthy investment climate and sustainable growth.

Complete Podcast Video: BETWEEN CREDIT STOCK RATINGS AND SUPERIOR STOCK: THE SECRET OF THE PERFORMANCE OF TWO PEFINDO INDEXES

Back to Home

Back to Home