Boosting ETF Transactions: Innovative Steps by BEI and KSEI

Jakarta – To enhance the growth of Exchange-Traded Fund (ETF) transactions in Indonesia's capital market, PT Bursa Efek Indonesia (BEI) and PT Kustodian Sentral Efek Indonesia (KSEI) have launched a new initiative that has attracted significant attention. Since July 1, 2024, Members of the Exchange (AB) and Dealer Participants (DP) benefit from an incentive of waived transaction fees in the secondary market. This includes a waiver of the Exchange Transaction Fee of 0.018% and the Transaction Settlement Service Fee at KSEI of 0.003%. This policy will be in effect until December 31, 2026, and will be reviewed every six months to ensure its effectiveness.

This initiative is designed not only to reduce cost burdens but also to boost liquidity and transaction volume of ETFs in Indonesia. With additional incentives for active DP in buying and selling ETFs, BEI and KSEI aim to create a more dynamic and competitive trading environment.

In the same week, BEI recorded several significant achievements. On Wednesday, July 3, 2024, PT Soraya Berjaya Indonesia Tbk (SPRE) officially listed on the BEI Acceleration Board. As the 26th company listed in 2024, SPRE operates in the Non-Cyclic Consumer Goods sector, focusing on textile products such as bed linens and covers.

On that day, two bond emissions were also listed on BEI. The Sustainable Bonds V by WOM Finance and the Sustainable Bonds IV by MNC Kapital Indonesia, worth Rp1 trillion and Rp399 billion respectively, received ratings of idAA+ and idBBB+ from PT Pemeringkat Efek Indonesia (PEFINDO). PT Bank Rakyat Indonesia (Persero) Tbk acted as the trustee for these emissions.

Closing the week on Friday, July 5, 2024, BEI listed the Bond I of the Network Ecosystem Integration and shares of PT Cipta Perdana Lancar Tbk (PART). The bonds, worth Rp600 billion, received a rating of idA- from PEFINDO with PT Bank Pembangunan Daerah Jawa Barat and Banten Tbk as the trustee. PART, a manufacturer in the automotive parts sector, became the 27th company listed on BEI this year.

Additionally, PT Dayamitra Telekomunikasi Tbk listed its Sustainable Bonds I and Sukuk Ijarah Berkelanjutan I with a total value of Rp250.24 billion, and PT Lautan Luas listed its Sustainable Bonds IV valued at Rp285.5 billion.

With a total of 65 bond and sukuk emissions from 43 issuers worth Rp63.36 trillion throughout 2024, BEI has demonstrated significant growth. Currently, the total number of bond and sukuk emissions on BEI stands at 576 with a nominal value of Rp473.79 trillion and USD54.758 million.

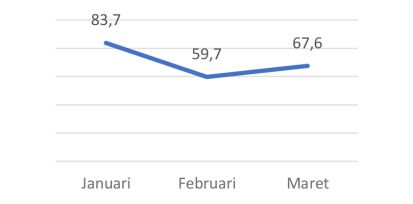

Trading data from BEI for the period of July 1 to 5, 2024, shows encouraging growth. The frequency of transactions increased by 24.44% to 947 thousand trades, market capitalization grew by 2.8% to Rp12.431 trillion, and the Composite Stock Price Index (IHSG) rose by 2.69% to 7,253.372.

Additionally, carbon trading on IDXCarbon in June 2024 recorded 313 tons of CO2 equivalent (tCO2e) valued at Rp19,277,000.00, reflecting Indonesia's commitment to reducing greenhouse gas emissions.

These initiatives and achievements reflect optimism and the significant potential of Indonesia's capital market. With appropriate incentives and ongoing support, BEI and KSEI continue to work towards creating an inclusive, dynamic, and sustainable investment ecosystem.

Back to Home

Back to Home