AEI Attends OJK Socialization Regarding New Issuer Obligations

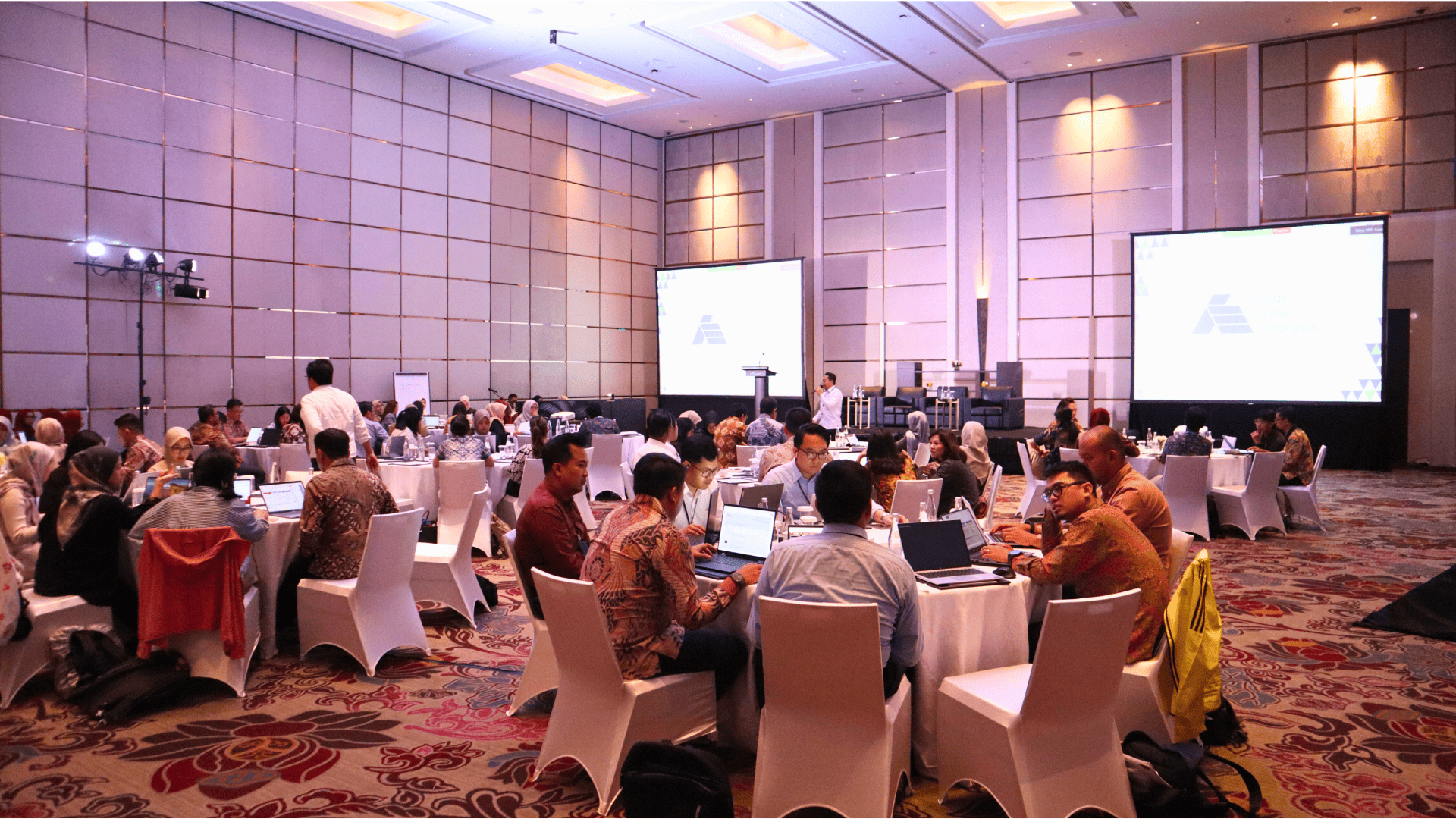

Jakarta, December 4 2024 – Association of Indonesian Issuers (AEI) attend events Socialization of Regulations for Issuers that Have Conducted Initial Public Offerings of Shares/Bonds, hosted by Financial Services Authority (OJK) in Jakarta. This activity aims to provide new issuers with an in-depth understanding of the obligations that must be fulfilled post- Initial Public Offering (IPO).

This event presented various important discussions, including periodic reporting obligations, disclosure of material information, as well as the implementation of good corporate governance (good corporate governance). This socialization was attended by representatives of new issuers and capital market stakeholders, creating a space for constructive discussion regarding the role of regulations in maintaining investor integrity and trust.

AEI's Role in Supporting New Issuers

On this occasion, the Executive Director of AEI, Mr. Gilman P. Nugraha, provides an overview of AEI's role in supporting issuers in the capital markets. "This outreach is an important step to help new issuers understand their obligations, so they can maintain compliance with regulations and build investor confidence," said Mr. Gilman.

He also emphasized the importance of collaboration between OJK and issuers to create a healthy and sustainable capital market ecosystem. "AEI is committed to continuing to support issuers in increasing their capacity, especially in fulfilling regulatory obligations and adopting good governance practices," he added.

Encouraging Compliance and Investor Confidence

This outreach highlights the important role of regulations in maintaining transparency and accountability of issuers in the capital market. By understanding their obligations, new issuers can strengthen the foundations of their business and ensure investor confidence in the company's performance.

AEI believes that continuous education and assistance for new issuers can strengthen the Indonesian capital market ecosystem. This is in line with AEI's vision to support issuers in creating responsible, competitive and sustainable business practices.

Back to Home

Back to Home