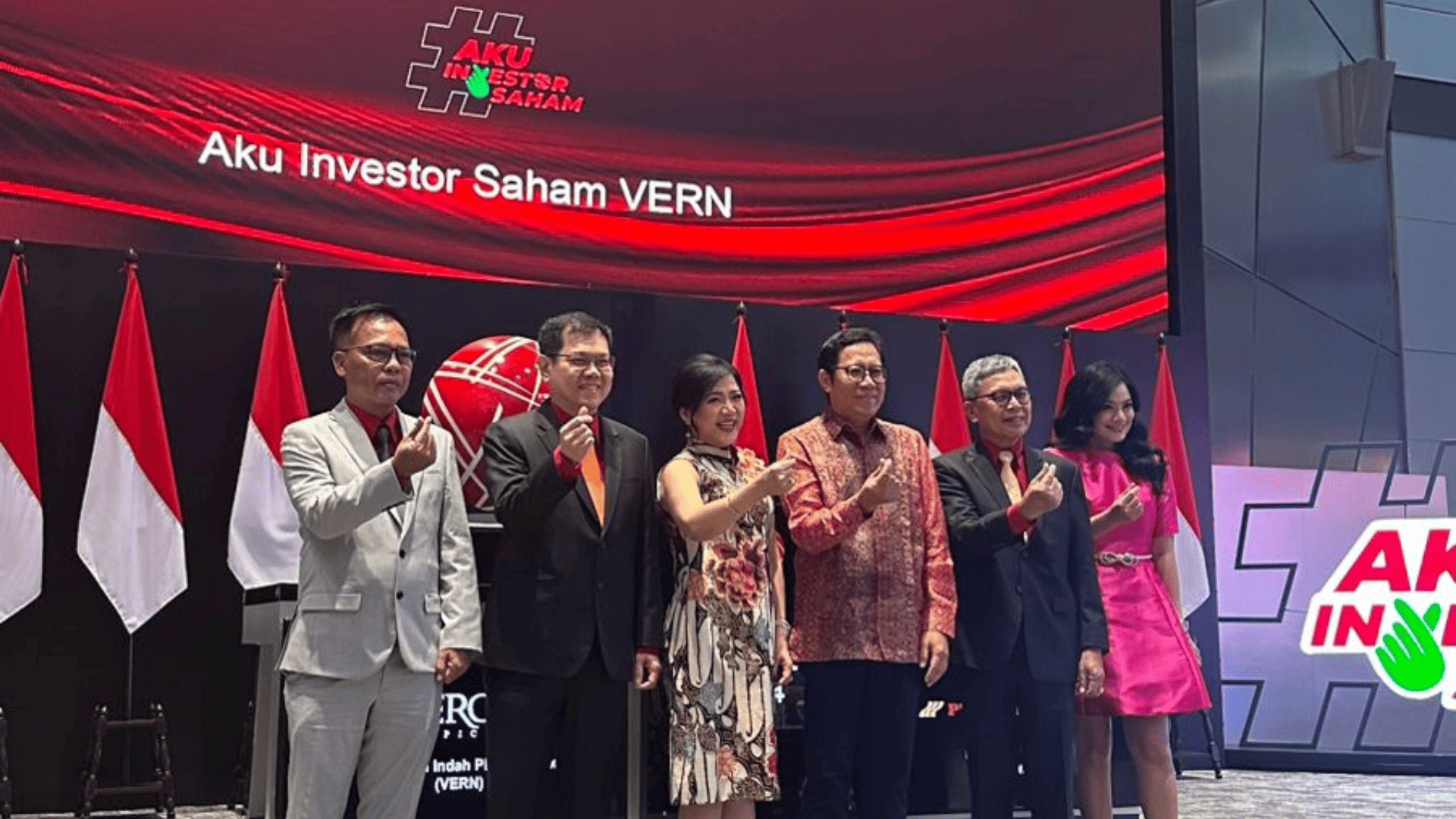

Verona Indah Pictures Officially Lists on the Indonesian Stock Exchange, Oversubscription of Shares is up to 10.34 Times

Jakarta, 8 October 2024 – PT Verona Indah Pictures Tbk. (VERN), a company operating in the film, video and television program distribution sector, officially listed its initial shares on the Indonesia Stock Exchange (BEI) today, Tuesday (8/10/2024). In the initial public offering (IPO), VERN released 1.12 billion shares or 11,216,500 lots of shares at an IPO price of IDR 195 per share. With this amount, the company managed to obtain fresh funds worth IDR 218.72 billion.

Investor enthusiasm for VERN's IPO is very high, as evidenced by demand reaching 11.59 billion shares or experiencing oversubscription of up to 10.34 times based on fixed allotment data. The number of orders far exceeded the number of shares released, namely 1.12 billion shares, equivalent to 23.54% of the issued and fully paid capital after the IPO.

Apart from issuing shares, VERN also offered Series I Warrants of 560.82 million shares or 15.39% of the total issued and fully paid shares. This warrant is given as an incentive for new shareholders, where every holder of 1 VERN share is entitled to get 1 free warrant. This warrant can be used to purchase new shares at an exercise price of IDR 216 per share during the period 8 April 2025 to 8 October 2025.

From the issuance of warrants, VERN has the potential to raise additional funds of IDR 121.13 billion. Warrants with the stock code VERN-W can also be traded on the regular, negotiated and cash markets until October 7 2025.

VERN will use the proceeds from this IPO for several purposes, including 7.70% for the acquisition of property at Graha Arteri Mas, West Jakarta. This property is owned by Pie Titin Suryani, who has an affiliate relationship with the company. The remaining funds will be used for working capital, especially to finance the production of films, soap operas, digital series, as well as the company's marketing and operational activities.

Meanwhile, the funds obtained from the implementation of Series I Warrants will be used entirely for daily operational needs, such as film and series production, payment of employee salaries and general operational costs.

Verona Indah Pictures' financial performance shows solid growth. In the first quarter of 2024, the company recorded a net profit of IDR 8.69 billion, a significant increase from IDR 3.84 billion in the same period the previous year. Sales also increased to IDR 67.09 billion, compared to IDR 43.76 billion in 2023.

Before the IPO, VERN share ownership was dominated by Pie Titin Suryani with 60.99%, Bedy Kunady with 38.67%, and Evy Supriati with 0.34%. PT UOB Kay Hian Sekuritas acted as underwriter for the securities issuance in this IPO.

Back to Home

Back to Home