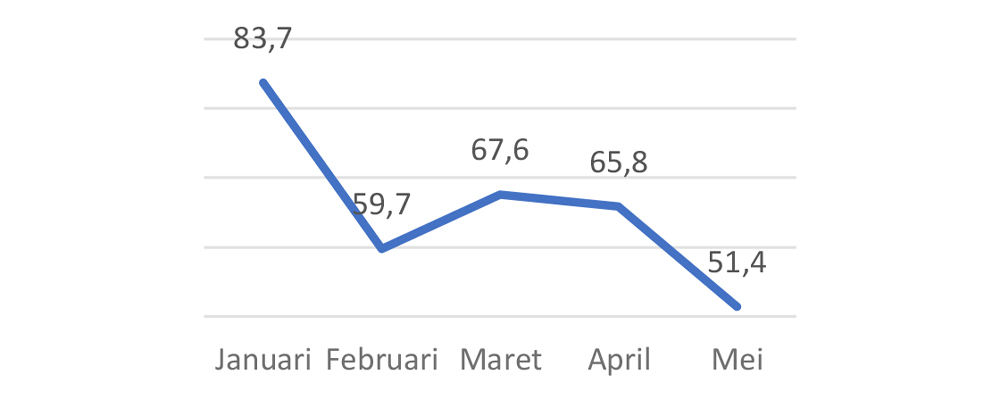

Capital Sensitivity Analysis Index (CSA Index) May 2024: Low Optimism of Market Participants

The Capital Sensitivity Analysis Index (CSA Index) for May 2024 showed a significant drop to 51.4, signaling a low level of optimism of market participants, even the lowest since the beginning of the year. Monetary and exchange rate related sentiments were the main focus, with the weakening Rupiah and uncertainty regarding the Fed's policy being the main factors affecting the market.

Market participants recognize that the JCI is likely to experience negative sentiment in the short term, mainly due to monetary uncertainty and Rupiah depreciation. However, they remain optimistic on the long-term performance of the JCI, targeting a gain to 7,727 in the next twelve months.

In terms of JCI's main driving sectors, the Energy sector was the main highlight for market participants in May, replacing the Financials sector which is usually the top choice. Uncertainty in monetary policy and potential strengthening in energy commodity prices were the main drivers of the sector's positive performance. In addition, the Basic Materials sector was also the choice of market participants for the month of May.

Learn more: Capital Sensitivity Analysis Index (CSA Index) Mei 2024

Back to Home

Back to Home