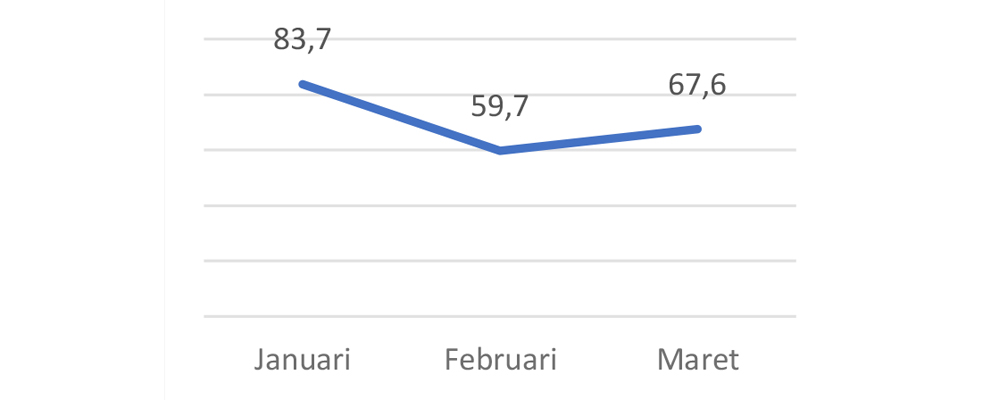

Capital Sensitivity Analysis Index (CSA Index) March 2024: Increased Confidence of Market Participants

The capital sensitivity analysis index (CSA Index) for March 2024 showed a significant increase, reaching 67.6. This increase indicates the increasing optimism of market participants post-election. Although it has not reached the level of optimism in January, market participants still predict that the JCI will experience an increase in March 2024. However, the market's tendency to hold back ahead of the Ramadan month has the potential to make transactions quiet. In addition, there are concerns over the Fed's policy regarding benchmark interest rates and geopolitical challenges that still exist.

Market participants' optimism towards JCI in the next 12 months has also increased, with most market participants expecting JCI to experience a bullish trend. The closing target for JCI in the next 12 months has also increased significantly, reaching 7,895, based on optimism towards the improving performance of JCI. Financials sector is the top choice as the JCI driver, followed by Energy and Consumer Non-Cyclicals sector, due to the positive performance that has been released.

In his commentary, NS. Aji Martono, Chairman of PROPAMI, welcomed the CSA Index March 2024 results which showed an increase in market participants' optimism, especially ahead of March trading and Ramadhan. It is expected that the JCI will increase in line with the increase in market optimism.

See complete research results here: Capital Sensitivity Analysis Index (CSA Index) March 2024

Back to Home

Back to Home