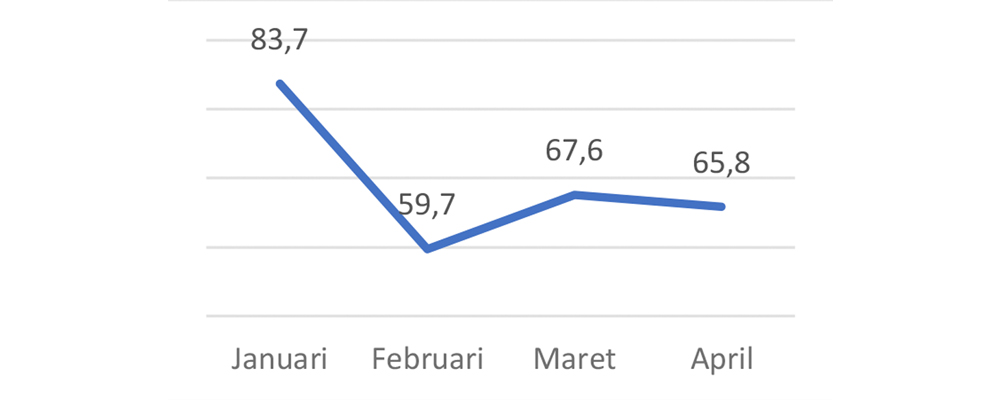

Capital Sensitivity Analysis Index (CSA Index) April 2024: Optimism remains low

The Capital Sensitivity Analysis Index (CSA Index) for April 2024 showed a decline to 65.8, signaling a low level of optimism from market participants. Nonetheless, the market is still hopeful that the JCI performance will improve this April taking into account the positive results from the first quarter of 2024 and post-election political stability. However, some negative sentiments such as economic slowdown, Fed's policy uncertainty regarding interest rate, and slowing global economic condition still haunt the market. It is expected that increased consumption during Ramadhan and outflows from the SBN market can strengthen the performance of the consumer sector and enrich the stock market.

For the long term, market participants are still optimistic on the JCI performance, despite the lower target compared to the previous month. Market participants continue to target the JCI to rally in the next twelve months, showing confidence in the growth potential of the JCI. Financials, Energy, and Consumer Non-Cyclicals sectors are predicted to be the main drivers of the JCI in April, in line with the positive performance they have shown in the past few months.

Learn Next: Capital Sensitivity Analysis Index (CSA Index) April 2024

Back to Home

Back to Home